So, there is debt service equalization in the Governor's bill (lowers 2nd tier to 19% from 26.24%) and the Senate bill (lowers first tier from 15.74% to 10% and raises equalizing factor), but there is nothing in the House bill. As Meat Loaf once crooned, "Two out of three's not bad." Meat Loaf would obviously have flunked the MCA math test for not knowing that two out of three equals 66.7%, but I won't quibble. Anyway, with the above scenario in mind, enjoy this classic Meat Loaf song.

Wednesday, March 29, 2017

Equalization in Senate Tax Bill. It's not a perfect provision, but given all the pushing I've done on debt service equalization over the past two decades to no avail, it would be like a starving man sending back Filet Mignon because it wasn't cooked quite right. The Senate Tax bill contains a provision that would lower eligibility on the first tier of the debt service equalization program from 15.74% to 10% and raise the equalizing factor from 55.33% of the state average ANTC to 75% of the state average ANTC. So far, so good. The wrinkle is that the increased equalization would be good only for property taxes payable in 2018, which would put districts on a yo-yo with taxpayers. While a one-year tax break would be appreciated by property taxpayers, districts would have to do a lot of explaining when the tax bill jumped again in 2019. But still, it's nice to be seated at a table in the legislative restaurant and having the opportunity to talk about debt service equalization and how it can promote long-term fairness in Minnesota's property tax system. I will be getting the data run to Deb Griffiths for distribution tomorrow, so watch your e-mail inbox.

So, there is debt service equalization in the Governor's bill (lowers 2nd tier to 19% from 26.24%) and the Senate bill (lowers first tier from 15.74% to 10% and raises equalizing factor), but there is nothing in the House bill. As Meat Loaf once crooned, "Two out of three's not bad." Meat Loaf would obviously have flunked the MCA math test for not knowing that two out of three equals 66.7%, but I won't quibble. Anyway, with the above scenario in mind, enjoy this classic Meat Loaf song.

So, there is debt service equalization in the Governor's bill (lowers 2nd tier to 19% from 26.24%) and the Senate bill (lowers first tier from 15.74% to 10% and raises equalizing factor), but there is nothing in the House bill. As Meat Loaf once crooned, "Two out of three's not bad." Meat Loaf would obviously have flunked the MCA math test for not knowing that two out of three equals 66.7%, but I won't quibble. Anyway, with the above scenario in mind, enjoy this classic Meat Loaf song.

Tuesday, March 28, 2017

Oops!!!!! I am not a dunce, but last night I predicted that today's hearing in the Senate E-12 Finance Committee that covered the omnibus education funding and policy bill would be a snoozer and sakes alive was I ever wrong. As with every hearing like this, the minority caucus offers amendments. In the modern era of legislative activity replete with budget targets, it is difficult for the minority to mount much of a challenge against the expenditures in the bill because the bill must remain reconciled to the committee's budget target. That means that revenue must be found in one portion of the bill to fund the amendments offered by the minority. Things were going on swimmingly. The minority caucus offered mild criticism of the bill and pointed out the programs in the Governor's budget that were funded with the $400 million in revenue above what it in the Senate bill. It was then that a string of amendments were offered by the minority and after each offering, the majority offered an amendment to the minority amendment that "found" the money to fund the initiative. Needless to say, some of the spending categories used to fund the amendments that eventually passed were not particularly popular with the minority, especially the deep cuts to the Minnesota Department of Education. I wouldn't say voices were raised, but there was a tension in the air that I wasn't expecting.

I always have to remind myself that some days I forget how old I am. Having been around the Legislature as long as I have, I tend to remember an era before the advent of budget resolutions with overall budget targets not being set until bills got into conference committees. In that era, members of the minority caucus would offer scads of amendments all with the intention of making the majority look bad by proposing to spend money well beyond what the majority intended to--but was not bound to--spend. Committee meetings and floor sessions would go on seemingly endlessly and more paper than could be produced from a couple of Sequoia Redwoods was generated. For the past couple of decades, budget resolutions that are set before the omnibus spending bills are developed gives the majority a formal mechanism to rule anything that violates the committee target out of order. It has truncated the process greatly and there are is both good and bad in that fact (at least from my vantage point).

The difference between the House and Senate proceedings and the amendments offered in the House is that the minority had a couple of target appropriations they zeroed in on to move money toward other programs. The Senate bill had no such zone the minority could tap into from which they could offer amendments without complication.

Speaking of the House bill, in the Tax Committee yesterday, an amendment was offered by Representative Loon--the bill's chief author--and subsequently adopted that dropped the basic formula increase from 1.5% per year to 1.25% with the revenue generated from the decrease directed toward the school readiness program for districts currently participating in the voluntary pre-kindergarten program. The revenue would only be available this biennium and would allow for a soft landing in these districts as the House bill repeals the voluntary pre-kindergarten program.

The Senate releases its tax bill tomorrow and it is hoped that there will be some equalization in the bill. I will report on that once it is confirmed.

Monday, March 27, 2017

The Bills are Rollin', Rollin', Rollin' Out. No Clint Eastwood herding the bill ala "Rawhide," but the Senate E-12 Funding Division rolled out its version of the omnibus education funding and policy bill this afternoon. Like the House bill, the target falls well short of the Governor's, but unlike the House bill, it's a very straightforward bill that doesn't seek to repeal current programs, de-link a lot of formulas, or implement broad new initiatives. Instead, the bill puts money on the formula at 1.5%, directs an estimated $10 million to helping districts absorb the correction in the Teacher Retirement Association shortfall, increases funding for the Minnesota Reading and Math Corps, and a modest funding increase for the Early Childhood Scholarship program. Along with funding for a set of isolated grant programs, it all adds up to the Senate Republican budget target of $300 million plus another $10 million that is expected to be generated from the sale of the Crosswinds Arts and Science Magnet School.

That's not to say this bill is bereft of any reform or new initiatives. It's just that education funding and policy bills of recent vintage have been chock full of all kinds of programs and policy changes that inflate the bill to the size where one needs a figurative forklift to haul it around. The bill expands on the reading at grade level by the end of third grade initiative that has been discussed over the past few years and contains the entirety of SF 4, Senator Eric Pratt's bill that establishes the Professional Educator Standards and Licensing Board. The teacher licensure article also contains language that would eliminate the requirement that teachers holding an Academic and Behavioral Strategist (ABS) license take additional credits to maintain their license and instructs the newly-minted board to study Minnesota's current array of special education licenses to gauge for overlap. The shortage of special education teachers has reached epic proportions and any measures undertaken to alleviate that shortage are needed.

Unlike the House bill that repeals the Governor's voluntary pre-kindergarten program, the Senate bill leaves it alone. It does not embrace the $175 million the Governor has provided for the program in his budget recommendations, but that provision is left untouched in the Senate bill. In her testimony, Education Commissioner Brenda Cassellius pointed out her disappointment that several items of importance to the Governor were missing from the bill, but there's no question that the Senate bill is less confrontational to the Governor than the House bill is.

The bill is slated for mark-up tomorrow morning, but it's difficult to envision many earth-shattering amendments being offered. The House bill rankled a number of DFL members of the House Education Funding Committee with the de-linking of the compensatory formula from the basic formula and the deep-sixing of the voluntary pre-kindergarten program, but with policies like that absent from the Senate bill, it's difficult to see what amendments would promote and where they would take money from to fund the proposals would come from. After that, the bill needs to head to the Senate Tax Committee (probably Thursday) and the Senate Finance Committee (probably Friday). Both the House and Senate bills will be on the floor early next week.

Stay tuned.

Federal Rumblings. President Trump signed the Congressional Review Act today and when it takes effect, two provisions relating to teacher preparation and teacher performance will be repealed. There hasn't been a lot of talk about how the new administration will pursue some of its stated educational goals, most notably school choice and charter school promotion (which is understandable given the attention given to health care policy with tax policy on deck), but today's action marks the return to state jurisdiction a handful of policies.

Here is an article from US News and World Report on the policy changes: Trump Signs Legislation Rolling Back Obama-era Regulations.

Sunday, March 26, 2017

Two Days of Parades. There were parades in the House Education Finance Committee last Thursday and Friday. Thursday's parade featured a long line of lobbyists (no floats or marching bands) providing their impressions of the House omnibus education funding bill. Most of the positive comments came from those who support the House's move on early childhood education, which repeal the voluntary pre-kindergarten program established last session, increase funding for early childhood scholarships by $25 million, and create a new office in the Minnesota Department of Administration that would have control over almost all of the early childhood education programs currently in place in Minnesota.

Most of the negative comments about the bill were measured. Most everyone realizes that given the committee's budget target of $258 million, it would be unlikely that there would be major increases in any program and that reaching a 2% increase in the basic formula for each of the next two years would be impossible. As it is, the House managed to put 1.5% on the formula in each year, which puts $274 million into that element of education funding. In order to put more money onto the formula than is actually in the House budget target, the committee cut the voluntary pre-kindergarten program, saving over $41 million in budget projections. After increasing the early childhood scholarship program by $25 million, there was $16 million left to move toward the formula. In other early childhood proposals, Pathway 2 scholarships, a program used by many school districts, would be eliminated and that also produced a number of concerns from witnesses.

One area of considerable concern is the House's recommendation to de-link the compensatory formula from the basic formula. As currently implemented, the compensatory formula is automatically inflated by increases in the basic formula. If the formula increases by 1%, the compensatory revenue base is also inflated by 1% in addition to any changes that may take place due to higher numbers (or lower numbers) of students on free- or reduced-price lunch and building concentration levels. The House proposes to cease the automatic increase and in its place institute a new targeted compensatory program that would distribute approximately $50 per free- or reduced-price lunch pupil unit that would be reduced proportionately for districts not reaching 95% participation on the MCA tests. In other words, a district reaching 80% of the 95% target would have their per pupil allotment reduced by 20%. While not as stark as moves to contain the growth of compensatory revenue and to redistribute the dollars, it would still likely move revenue away from districts with the greatest challenges in terms of closing the achievement gap. Stay tuned for the developments here. While the Commissioner of Education and most of the district-based education lobbying organizations expressed either opposition or skepticism to the move, developments in this area will be something to watch. It is expected the Governor would strongly oppose this change, we are a long way from when funding bills and a tax bill will hit the Governor's desk.

In my testimony (and thankfully it came near the end so there was a time limit), I hit many of the same points as others with one exception--that was also mentioned by AMSD and MREA--and that was the failure of the committee to hear Representative Joe McDonald's HF 1351, the referendum and debt service equalization bill that would have delivered needed tax relief to low property wealth school districts throughout the state. None of the organizations that supported this bill expected the revenue needed for the program to come from the education committee's target and instead wanted it to be considered as part of the tax bill, which is already carrying considerable education tax relief in the form of the Ag Bond Credit for debt service levies and expanded education tax credits, tax deductions, and scholarship contributions for private school tuition. But to get to the Tax Committee for possible consideration in that committee's target, it would have to be heard by the Education Finance Committee. Without that hearing, it stalled completely and it is disappointing that in a year when the House is suggesting a $1.3 billion tax cut bill, that some money for equalization could not have been carved out for that purpose.

On Friday, it was a paper parade as sixteen amendments to the omnibus education funding bill were considered. Most of the amendments that passed were technical in nature and nearly all of the amendments offered by DFLers failed. The theme for the DFLers centered around the changes to the compensatory formula and the proposed shuttering of the Perpich Center for Arts Education that is contained in the bill. Revenue for the programs proposed to be funded by the DFLers--full service community schools, after-school programs, student teaching stipends for teaching candidates in shortage areas, and school-linked mental health grants--came from the proposed increase in the early childhood scholarship program. The exchanges in committee became contentious at several junctures and a charge was leveled by the DFLers that the bill is out-of-balance because it assumes revenue that is yet to be collected in the form of the sale of the building formerly used for the Crosswinds School for the Arts and Sciences. The state bonded for that school several years back, but the school is slated for closure and the building will be sold. That will generate revenue, but it is difficult to peg an amount or develop a timeline by which the revenue could be used.

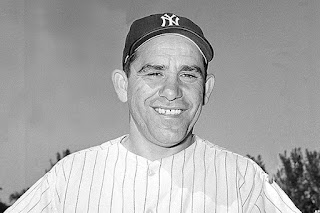

The result of Thursday and Friday made my recall that words of that famous educational philosopher Yogi Berra, who once said "It's like deja vu all over again." The Governor's education target sits at just over $700 million, very close to where he was two years ago. Further, the Governor doubled down on his voluntary pre-kindergarten program with his supplemental budget. While the House education budget target of $258 million is slightly more than $100 million more than its target two years ago, it still is far below that of the Governor's. The Senate target of $300 million is a bit below the $350 million target of the DFL Senate majority two years ago, it is not that much lower as to change the overall situation. The Legislature is low and the Governor is high. We will know more about the Senate bill when it is released tomorrow, but like the House, I don't expect it to be too much different than the House's bill.

The Governor reacted to the House bill with this very short statement:

Most of the negative comments about the bill were measured. Most everyone realizes that given the committee's budget target of $258 million, it would be unlikely that there would be major increases in any program and that reaching a 2% increase in the basic formula for each of the next two years would be impossible. As it is, the House managed to put 1.5% on the formula in each year, which puts $274 million into that element of education funding. In order to put more money onto the formula than is actually in the House budget target, the committee cut the voluntary pre-kindergarten program, saving over $41 million in budget projections. After increasing the early childhood scholarship program by $25 million, there was $16 million left to move toward the formula. In other early childhood proposals, Pathway 2 scholarships, a program used by many school districts, would be eliminated and that also produced a number of concerns from witnesses.

One area of considerable concern is the House's recommendation to de-link the compensatory formula from the basic formula. As currently implemented, the compensatory formula is automatically inflated by increases in the basic formula. If the formula increases by 1%, the compensatory revenue base is also inflated by 1% in addition to any changes that may take place due to higher numbers (or lower numbers) of students on free- or reduced-price lunch and building concentration levels. The House proposes to cease the automatic increase and in its place institute a new targeted compensatory program that would distribute approximately $50 per free- or reduced-price lunch pupil unit that would be reduced proportionately for districts not reaching 95% participation on the MCA tests. In other words, a district reaching 80% of the 95% target would have their per pupil allotment reduced by 20%. While not as stark as moves to contain the growth of compensatory revenue and to redistribute the dollars, it would still likely move revenue away from districts with the greatest challenges in terms of closing the achievement gap. Stay tuned for the developments here. While the Commissioner of Education and most of the district-based education lobbying organizations expressed either opposition or skepticism to the move, developments in this area will be something to watch. It is expected the Governor would strongly oppose this change, we are a long way from when funding bills and a tax bill will hit the Governor's desk.

In my testimony (and thankfully it came near the end so there was a time limit), I hit many of the same points as others with one exception--that was also mentioned by AMSD and MREA--and that was the failure of the committee to hear Representative Joe McDonald's HF 1351, the referendum and debt service equalization bill that would have delivered needed tax relief to low property wealth school districts throughout the state. None of the organizations that supported this bill expected the revenue needed for the program to come from the education committee's target and instead wanted it to be considered as part of the tax bill, which is already carrying considerable education tax relief in the form of the Ag Bond Credit for debt service levies and expanded education tax credits, tax deductions, and scholarship contributions for private school tuition. But to get to the Tax Committee for possible consideration in that committee's target, it would have to be heard by the Education Finance Committee. Without that hearing, it stalled completely and it is disappointing that in a year when the House is suggesting a $1.3 billion tax cut bill, that some money for equalization could not have been carved out for that purpose.

On Friday, it was a paper parade as sixteen amendments to the omnibus education funding bill were considered. Most of the amendments that passed were technical in nature and nearly all of the amendments offered by DFLers failed. The theme for the DFLers centered around the changes to the compensatory formula and the proposed shuttering of the Perpich Center for Arts Education that is contained in the bill. Revenue for the programs proposed to be funded by the DFLers--full service community schools, after-school programs, student teaching stipends for teaching candidates in shortage areas, and school-linked mental health grants--came from the proposed increase in the early childhood scholarship program. The exchanges in committee became contentious at several junctures and a charge was leveled by the DFLers that the bill is out-of-balance because it assumes revenue that is yet to be collected in the form of the sale of the building formerly used for the Crosswinds School for the Arts and Sciences. The state bonded for that school several years back, but the school is slated for closure and the building will be sold. That will generate revenue, but it is difficult to peg an amount or develop a timeline by which the revenue could be used.

It's deja vu all over again.

The result of Thursday and Friday made my recall that words of that famous educational philosopher Yogi Berra, who once said "It's like deja vu all over again." The Governor's education target sits at just over $700 million, very close to where he was two years ago. Further, the Governor doubled down on his voluntary pre-kindergarten program with his supplemental budget. While the House education budget target of $258 million is slightly more than $100 million more than its target two years ago, it still is far below that of the Governor's. The Senate target of $300 million is a bit below the $350 million target of the DFL Senate majority two years ago, it is not that much lower as to change the overall situation. The Legislature is low and the Governor is high. We will know more about the Senate bill when it is released tomorrow, but like the House, I don't expect it to be too much different than the House's bill.

The Governor reacted to the House bill with this very short statement:

“It looks like the House Republicans intend to use pre-kindergarten

funding as a bargaining chip in the upcoming budget negotiations. It is

appalling that the best interests of Minnesota four year-olds are being used as

a political bargaining chip by House Republicans.”

Fasten your seatbelts, it's going to be a bumpy night.

Seeing that quote, I could only think of the words of another famous educational philosopher Bette Davis in her immortal words from the winner of the 1951 Oscar for Best Picture All About Eve. Switch the word "session" for "night," and I think it about sums it all up. One advantage this year is that while things will get exciting, it appears the Legislature may get its bills to the Governor in a time frame that will allow a good couple of weeks for negotiations between legislative leadership and the administration. That may or may not matter, but I think everyone's cards will be on the table before the last weekend of the session.

Wednesday, March 22, 2017

The Appetizers are Served. Think of the Legislative Session as a dinner party. The first few months are spent over apertifs with lots of conversation and then out come the hors d'oeuvres in the form of the omnibus bills. The omnibus policy bills were released and discussed last week and today we saw the first of the omnibus funding and tax bills in the House. The centerpiece of the House program this year will be their tax bill, in which they propose to cut Minnesota taxes by over $1.3 billion. In order to achieve this goal, they are spending less than the Governor above the base in most program categories and less than the base in some budget categories.

HF 890, the House Education Funding and Policy Omnibus Bill (the omnibus policy provisions of HF 1376 have been folded into the same bill as the funding provisions) was released today and there are a few surprises in the $258 million spending put forward in the bill. The basic formula is increased by 1.5% in each year of the biennium; $70/PU for the 2017-18 school year and $71/PU for the 2018-19 school year. Then things start to get interesting. First off, the compensatory formula is de-linked from increases in the basic formula and a new $24 million compensatory formula not based on concentration of poverty is implemented. That trade washes out into $2 million of savings for the bottom line as de-linking saves more than the new program spends. Further, the entire voluntary pre-kindergarten program enacted last year is repealed. More about that later.

The biggest changes in the bill come in the area of early childhood education. Under the bill, administration of most early childhood programs would be folded into a new office to be housed at the Minnesota Department of Administration. In place of the Governor's voluntary pre-kindergarten program, the House bill increases school readiness by $8.5 million and the early childhood scholarship program $24.6 million. As we witnessed during the last biennium, the House is opposed to the voluntary pre-kindergarten program. I just thought they would leave it alone, but the only thing that surprises me is that I am sometimes still surprised. The other surprise is that the bill closes the Perpich Center for the Arts.

Here are the highlights of the bill, some of which were mentioned in the text above:

There will be a lot of discussion on these provisions and policy changes over the next two months.

Here are the links to the bill and bill summary on HF 890.

Bill: HF 890 Language

Summary: HF 890 Summary

Budget Tracking Sheet: HF 890 Budget

HF 890, the House Education Funding and Policy Omnibus Bill (the omnibus policy provisions of HF 1376 have been folded into the same bill as the funding provisions) was released today and there are a few surprises in the $258 million spending put forward in the bill. The basic formula is increased by 1.5% in each year of the biennium; $70/PU for the 2017-18 school year and $71/PU for the 2018-19 school year. Then things start to get interesting. First off, the compensatory formula is de-linked from increases in the basic formula and a new $24 million compensatory formula not based on concentration of poverty is implemented. That trade washes out into $2 million of savings for the bottom line as de-linking saves more than the new program spends. Further, the entire voluntary pre-kindergarten program enacted last year is repealed. More about that later.

The biggest changes in the bill come in the area of early childhood education. Under the bill, administration of most early childhood programs would be folded into a new office to be housed at the Minnesota Department of Administration. In place of the Governor's voluntary pre-kindergarten program, the House bill increases school readiness by $8.5 million and the early childhood scholarship program $24.6 million. As we witnessed during the last biennium, the House is opposed to the voluntary pre-kindergarten program. I just thought they would leave it alone, but the only thing that surprises me is that I am sometimes still surprised. The other surprise is that the bill closes the Perpich Center for the Arts.

Here are the highlights of the bill, some of which were mentioned in the text above:

- 1.5% increase in the basic formula in each of the next two years $(274.6 million).

- Current compensatory revenue program de-linked from increases in the basic formula (Savings of $26.6 million).

- New targeted compensatory revenue formula created ($24.0 million).

- Voluntary Pre-kindergarten program repealed (Savings of $41.0 million).

- No money to help districts correct TRA deficit (Governor had $68.6 million).

- No increase in special education formula (Governor had $45.4 million increase).

- $4 million for teacher loan forgiveness.

- $2.6 million cut in ABE funding by reducing growth factor in formula.

- New new Office of Early Education and Development.

- Increases Early Childhood Scholarship Program ($24.6 million).

- Drops age of eligibility for scholarship down to birth.

- Eliminates Pathway 2 Scholarships.

- Increases School Readiness Formula ($8.5 million) and makes charter schools eligible for school readiness.

- De-links ECFE allowance from the basic formula.

There will be a lot of discussion on these provisions and policy changes over the next two months.

Here are the links to the bill and bill summary on HF 890.

Bill: HF 890 Language

Summary: HF 890 Summary

Budget Tracking Sheet: HF 890 Budget

Tuesday, March 21, 2017

Committees Winding Down. With the final target announced--the House Majority Caucus' target for E-12 is $258 million above base--the finance committees in the House and Senate will be putting together their bills very shortly. It was announced today that the House Education Finance Committee may be rolling out their bill tomorrow and will take public testimony on Thursday.

I was remarking to someone today that it's almost like I'm Rip van Winkle, but instead of falling asleep for 20 years, I only fell asleep for two. Like two years ago, the Governor doubled-down on voluntary universal pre-kindergarten in his supplemental budget and both houses of the Legislature have come in well below his nearly $700 million above base budget target (almost identical to what it was two years ago). While the House target is about $100 million above what it was two years ago, it is still below what is needed to get to a 2% increase in the basic formula (as is the case in the Senate). It will be interesting to see what rolls out in the next couple of days.

The House Education Finance Committee did have a hearing today in which they heard Representative Ron Kresha's HF 1558, a bill that would change the way districts bid for insurance. The big change in the bill is that a district and the bargaining units would have to agree in order to request a bid from PEIP, which is a substantial change from current law when the bargaining units can request a bid without district approval.

The Senate E-12 Policy Committee met to listen to a presentation by the Legislative Auditor on their recently-released study on Minnesota's student testing system.

Here is a link to the report's page on the Legislative Auditor's site: Standardized Student Testing Report

I was remarking to someone today that it's almost like I'm Rip van Winkle, but instead of falling asleep for 20 years, I only fell asleep for two. Like two years ago, the Governor doubled-down on voluntary universal pre-kindergarten in his supplemental budget and both houses of the Legislature have come in well below his nearly $700 million above base budget target (almost identical to what it was two years ago). While the House target is about $100 million above what it was two years ago, it is still below what is needed to get to a 2% increase in the basic formula (as is the case in the Senate). It will be interesting to see what rolls out in the next couple of days.

The House Education Finance Committee did have a hearing today in which they heard Representative Ron Kresha's HF 1558, a bill that would change the way districts bid for insurance. The big change in the bill is that a district and the bargaining units would have to agree in order to request a bid from PEIP, which is a substantial change from current law when the bargaining units can request a bid without district approval.

The Senate E-12 Policy Committee met to listen to a presentation by the Legislative Auditor on their recently-released study on Minnesota's student testing system.

Here is a link to the report's page on the Legislative Auditor's site: Standardized Student Testing Report

Sunday, March 19, 2017

Significant Committee Meeting Last Friday. The Senate E-12 Funding Committee met last Friday morning from 9:00 AM until the early afternoon. The committee covered a number of very interesting bills, some of which will be folded into the omnibus education funding bill and some that will likely move on their own. Perhaps the most interesting bill is Senator (and Committee Chair) Carla Nelson's bill--SF 1885--that would establish Foundation and Incentive Revenue (FAIR). This bill grew out of a desire to channel additional revenue to smaller school districts and is a bit of an offshoot from Senator Tom Bakk's SF 87, a bill that would have raised the pupil eligibility number from 960 pupils to 1,500 pupils. Going in a bit of a different direction, SF 1885 provides a flat $200,000 to all school districts that is adjusted up or down based upon a school district's three-year rolling average on MCA scores. Translating this into examples, if a district is small, the per pupil benefit ($200,000/Number of Pupils) is quite large. If you are a large district, the effect is the opposite. The $200,000 number changes due to student performance and higher test scores will lead to more revenue, which will add or subtract from the per pupil value.

The bill spends approximately $60 million, which would translate to approximately $60 per pupil. A back of the envelope calculation would indicate that a district of around 3,300 pupils with average performance on the MCAs would be the break point where the equation balances. In other words, if you are above 3,300 pupils, you are better served by money going on the formula (provided your student performance is average or above average). If you are under 3,300 pupils, the distribution of revenue in SF 1885 will probably favor you. But again, a lot depends on a district's student performance.

There's no question that how smaller school districts are funded needs to be investigated and it's probably a reason why the school finance task force in Representative Urdahl's HF 149 needs to be pursued. We may have reached a point in the education funding formula where it may collapse under its own weight. At any rate, watch for SF 1885's progress as the Senate puts together its omnibus education funding bill.

Chair Nelson's SF 2094 was also heard. This bill would increase the special education formula beginning next biennium and would add approximately $80 million to the budget tails. There would be no new revenue in the next two years under this proposal, but special education costs are expected to continue to rise, making this bill very helpful to school districts throughout the state.

E-12 Policy Chair Senator Eric Pratt had four bills up, including the omnibus education policy bill--SF 1222--and SF 4, the bill that would establish the Professional Educator Licensing and Standards Board. SF 1475, another Senator Pratt bill, would provide financial incentives to school districts to promote participation in the state MCA testing program. More and more parents are opting their students out of MCA testing, making the value of the tests increasingly questionable.

Other bills heard were:

SF 609-Dahms-Increasing Appropriation to Promote Participation in SW State Program that Provides Opportunities for Paraprofessionals to Obtain Special Education Teaching Licenses

SF 1792-Nelson-Increase in Adult Basic Education Funding

SF 1698-Nelson-Appropriation for Rochester Children's Museum

SF 1567-Pratt-Funding for African-American Registry to Improve Cultural Competency of Teaching Candidates

Targets Being Announced. The Governor and the Senate Republicans announced their budget targets on Friday and the House Republicans will announce theirs tomorrow (Monday) morning. The Governor adds $100 million to his voluntary pre-kindergarten program in his supplemental budget and leaves the rest of his education budget released in January alone. This puts his revenue over base request at approximately $700 million, almost exactly the same as he proposed in 2015.

The Senate, while not outlining any specific initiatives, proposes to add $300 million above the current law base. This gets a bit confusing because the Senate Republican press release shows that the biennium-to-biennium increase will be be $1.144 billion. However, the February forecast shows that the education funding base will increase by $844 million without any legislative action. The $844 million is generated due to higher pupil enrollment, the final year phase-in of the Long Term Facilities Maintenance Revenue Program, an increase in special education funding due to the growth factor in that formula, and the carrying forward of the second year increase in the basic formula enacted last biennium. I will be writing more about this as things continue to take shape.

The bill spends approximately $60 million, which would translate to approximately $60 per pupil. A back of the envelope calculation would indicate that a district of around 3,300 pupils with average performance on the MCAs would be the break point where the equation balances. In other words, if you are above 3,300 pupils, you are better served by money going on the formula (provided your student performance is average or above average). If you are under 3,300 pupils, the distribution of revenue in SF 1885 will probably favor you. But again, a lot depends on a district's student performance.

There's no question that how smaller school districts are funded needs to be investigated and it's probably a reason why the school finance task force in Representative Urdahl's HF 149 needs to be pursued. We may have reached a point in the education funding formula where it may collapse under its own weight. At any rate, watch for SF 1885's progress as the Senate puts together its omnibus education funding bill.

Chair Nelson's SF 2094 was also heard. This bill would increase the special education formula beginning next biennium and would add approximately $80 million to the budget tails. There would be no new revenue in the next two years under this proposal, but special education costs are expected to continue to rise, making this bill very helpful to school districts throughout the state.

E-12 Policy Chair Senator Eric Pratt had four bills up, including the omnibus education policy bill--SF 1222--and SF 4, the bill that would establish the Professional Educator Licensing and Standards Board. SF 1475, another Senator Pratt bill, would provide financial incentives to school districts to promote participation in the state MCA testing program. More and more parents are opting their students out of MCA testing, making the value of the tests increasingly questionable.

Other bills heard were:

SF 609-Dahms-Increasing Appropriation to Promote Participation in SW State Program that Provides Opportunities for Paraprofessionals to Obtain Special Education Teaching Licenses

SF 1792-Nelson-Increase in Adult Basic Education Funding

SF 1698-Nelson-Appropriation for Rochester Children's Museum

SF 1567-Pratt-Funding for African-American Registry to Improve Cultural Competency of Teaching Candidates

Targets Being Announced. The Governor and the Senate Republicans announced their budget targets on Friday and the House Republicans will announce theirs tomorrow (Monday) morning. The Governor adds $100 million to his voluntary pre-kindergarten program in his supplemental budget and leaves the rest of his education budget released in January alone. This puts his revenue over base request at approximately $700 million, almost exactly the same as he proposed in 2015.

The Senate, while not outlining any specific initiatives, proposes to add $300 million above the current law base. This gets a bit confusing because the Senate Republican press release shows that the biennium-to-biennium increase will be be $1.144 billion. However, the February forecast shows that the education funding base will increase by $844 million without any legislative action. The $844 million is generated due to higher pupil enrollment, the final year phase-in of the Long Term Facilities Maintenance Revenue Program, an increase in special education funding due to the growth factor in that formula, and the carrying forward of the second year increase in the basic formula enacted last biennium. I will be writing more about this as things continue to take shape.

Thursday, March 16, 2017

Early Childhood Discussion Goes Late. Well, not that late, but the discussion of a number of bills related to early childhood comprised the first real night education-related committee meeting of the session. At the risk of making light of the discussion, I'll say that in history there has been the War of the Roses, the American Civil War, and the Peloponnesian War, but what has been brewing at the Minnesota Legislature over the past decade is the War over Early Childhood Paradigms. One side is largely on the side of school-based or school-administered programs and programs administered through the Department of Human Services while the other side is skeptical of that approach and would like to go toward a parent-choice scholarship program. I have oversimplified the case, but support and opposition on the bills discussed tonight seem to break along those lines. Two of the bills--HF 1491 and HF 2259--presented tonight are authored by House Education Finance Chair Jenifer Loon so it is obvious they will have traction. HF 1491 would expand eligibility and eliminate the individual scholarship dollar cap for Pathway 1 scholarships down to birth and would eliminate Pathway 2 scholarships entirely. That would certainly put a lot of school-based programs that use the Pathway 2 scholarships at risk. HF 2259 would create a new agency that would handle all early childhood programs. Proponents believe that putting all of the early childhood programs under one roof would promote efficiency and allow analysts to determine which programs are working best. They also believe that providing more parent choice will help narrow the programs to those with the highest level of need. Opponents believe that the current framework of programs--patchwork though it may appear--provides flexibility to school districts and other service providers and that combining the programs may lead to a system that won't meet the needs of a broad range of students. Representative Ron Kresha's HF 1997 contains elements of HF 1491 and the home-visiting program contained in Representative Loon's HF 1801. Representative Julie Sandstede's HF 1684, which increases funding for the school readiness program was also heard.

The rest of the committee time was dedicated to bills relating to alternative teacher licensure (HF 1663-Chief Author Representative Sondra Erickson), increasing the use of third-party billing for special education evaluation services (HF 1338-Chief Author Representative Paul Thissen), increasing the reimbursement for school lunches (HF 1217-Chief Author Representative Deb Kiel), and a bill modifying the regional public library funding formula (HF 1382-Chief Author Representative Bud Nornes).

Representative Steve Drazkowski's HF 654 was also heard. Representative Drazkowski has tried to limit the dates on which school districts can hold bond and capital project elections and HF 654 states that districts can only go to the voters on election day in the even- or odd-numbered years. In previous years, Representative Drazkowski's proposals attempted to limit it further to election years in even-numbered years only. The bill also provides for a reverse referendum where voters could vote to reduce levies implemented by the school board.

Legislative Auditor's Report on Standardized Student Testing Released. The House Education Innovation Policy Committee heard a presentation by the Office of the Legislative Auditor on their recent report on standardized testing. In sum, the report gives the Minnesota Department of Education high marks in the administration of the program, but the report questions the value of standardized testing. Here is a link to the report's page with links to the report's executive summary and text of the full report.

Office of the Legislative Auditor Report on Standardized Student Testing

LIFO Bill Passes House. On a vote of 71-59, the House of Representatives passed HF 1478, the bill that would change how layoffs would be implemented at the district level. Basically, seniority would no longer be the determinant in making staffing decisions when cuts are made. Because the bill went to the floor on its own, it's difficult to discern the next step. The bill has not been heard in the Senate, so it's dead on that side of University Avenue, but the House could put it in its version of the omnibus education bill. Even if it is included in the final omnibus bill, it would likely be greeted with a veto by the Governor.

The rest of the committee time was dedicated to bills relating to alternative teacher licensure (HF 1663-Chief Author Representative Sondra Erickson), increasing the use of third-party billing for special education evaluation services (HF 1338-Chief Author Representative Paul Thissen), increasing the reimbursement for school lunches (HF 1217-Chief Author Representative Deb Kiel), and a bill modifying the regional public library funding formula (HF 1382-Chief Author Representative Bud Nornes).

Representative Steve Drazkowski's HF 654 was also heard. Representative Drazkowski has tried to limit the dates on which school districts can hold bond and capital project elections and HF 654 states that districts can only go to the voters on election day in the even- or odd-numbered years. In previous years, Representative Drazkowski's proposals attempted to limit it further to election years in even-numbered years only. The bill also provides for a reverse referendum where voters could vote to reduce levies implemented by the school board.

Legislative Auditor's Report on Standardized Student Testing Released. The House Education Innovation Policy Committee heard a presentation by the Office of the Legislative Auditor on their recent report on standardized testing. In sum, the report gives the Minnesota Department of Education high marks in the administration of the program, but the report questions the value of standardized testing. Here is a link to the report's page with links to the report's executive summary and text of the full report.

Office of the Legislative Auditor Report on Standardized Student Testing

LIFO Bill Passes House. On a vote of 71-59, the House of Representatives passed HF 1478, the bill that would change how layoffs would be implemented at the district level. Basically, seniority would no longer be the determinant in making staffing decisions when cuts are made. Because the bill went to the floor on its own, it's difficult to discern the next step. The bill has not been heard in the Senate, so it's dead on that side of University Avenue, but the House could put it in its version of the omnibus education bill. Even if it is included in the final omnibus bill, it would likely be greeted with a veto by the Governor.

Wednesday, March 15, 2017

Things Flying All Over the Place. With the policy deadlines pretty much in the past, the funding divisions for the various categories of state funding have been running through a lot of bills. Most of these bills probably won't find their way into the omnibus funding bills, but a number of interesting perspectives are being presented.

Here are some of the highlights from the bills that have been heard and the committees in which they were heard.

Here are some of the highlights from the bills that have been heard and the committees in which they were heard.

- One bill getting quite a bit of attention is HF 1963/SF 1362 dealing with the use of proceeds from bond sales emanating from voter-approved bond referenda. Under the bill, a district could not increase instructional space within five years after closing a building without a positive vote from the community. The discussion of this bill emanates from decisions to close buildings made in the Stillwater district and the subsequent passage of a bond issue by the Stillwater voters just last month. This has caused some consternation in neighborhoods where the buildings were closed, but there's no question a bill like this applied statewide could cause quite a few problems. The bill has been heard in both the House and Senate and is on the list for possible inclusion in the omnibus education funding bill in each house. Stay tuned.

- Senate Education E-12 Funding Chair's SF 1556 was heard on Monday in the Senate E-12 Committee. The bill calls for a 2% increase in the general education basic formula in each of the next two years. It mirrors the Governor's budget recommendation and has a House companion in HF 1716, authored by House Education Finance Chair Jenifer Loon. There is growing sentiment that this is where the formula increase will end up, but I'm also hearing rumblings that it may be a long road to get there. Everyone will know more when the budget targets are set and it wouldn't be a surprise if the spending contained in those legislative targets will be well below the amount needed--$379 million--to fund a 2%/2% set of increases. This is another one to watch unfold.

- The House Education Finance Committee heard the bill that would abolish the Perpich Center for Arts Education (HF 1825) today. The push to close the center springs from the report performed by the Office of the Legislative Auditor that was critical of the internal controls and operations at the center. While the report didn't expressly call for the center to be closed (and a new board of directors has been appointed), the future of the center is being discussed. The fate of the Crosswinds School for Arts and Sciences (a charter school) is also intertwined with discussion of the Perpich School.

- Senator Mary Kiffmeyer has introduced SF 1332, a bill that would create a new revenue stream that would be based on a flat per pupil amount that is not linked to any of the categorical funding programs and was heard on Wednesday in the Senate E-12 Finance Committee. A surefire way to start a verbal conflagration at the Legislature is to suggest that categoricals like compensatory and sparsity should be de-linked from the basic formula. Rather than go that route, Senator Kiffmeyer has suggested that a new revenue stream not connected in any way to the categoricals could deliver revenue in a way that would help those districts that generate below average amounts of categorical revenue. It will be interesting to see if this gets any traction because it is a concept that does need to be discussed.

- Senator Roger Chamberlain's SF 1252 was heard on Monday in the Senate E-12 Finance Committee. This bill would raise the equalizing factor on the first $300 per pupil unit of referendum levy (either board-approved or voter-approved) from $880,000 of referendum market value to $950,000 of referendum market value. The total cost of the bill is approximately $10 million, which would be spread as property tax relief to all but a handful of districts in the state. This approach provides relief to a broader base of school districts that Senator Dave Senjem's SF 1206, which is targeted to lower property wealth school districts in the second and third tiers of the referendum levy (and spends four times the amount of SF 1252). There is no question that a strong case can be made for either of these approaches and hopefully that discussion will take place this session. The equalization issue has yet to receive a lot of attention in the House, but there is still time to have a hearing on this issue. What needs to be stressed is this is not a subject for the education committees where the tax relief contained in the equalization bills would be pitted against the basic formula and other programs. This discussion needs to take place in the tax committee.

- The private school scholarship bills carried by Senator Chamberlain in the Senate and Representative Ron Kresha in the House are on their way to their respective tax committees and will likely be part of the omnibus tax bills that will ultimately be passed by the Legislature (and will then likely be vetoed by the Governor).

Sunday, March 12, 2017

Weekend Report. The Senate E-12 Policy Committee met Friday and passed its version of the 2017 omnibus education policy bill, SF 1222. The bill has a few more provisions than the House version (and some will find these provisions controversial), but it still comes in under 50 pages, which is considerably lighter than most years. The policy contained in the bill that most in the E-12 world will find controversial is the permissive language that lets public school students attend a private school for nonsectarian academic credits. This policy was introduced as SF 1281, authored by Senator Justin Eichorn and heard in the E-12 Policy Committee the day before. The language in the bill changes the "must grant credit" in the original bill to a "may grant credit," which certainly softens some, but not all, of the criticism.

Other provisions emanating from bills heard during the session include:

Other provisions emanating from bills heard during the session include:

- Allowing districts to maintain a supply of asthma inhalers.

- Requirement for districts to report their monthly utility consumption into the B3 benchmarking program.

- Expanded efforts to ensure students are reading at grade level by the end of third grade.

- A number of provisions relating to charter school operation and allowing a charter school to change authorizers.

Here is a copy of the language that the committee was working from at Friday's hearing. Two amendments were adopted and will be incorporated into the first engrossment of the bill. I will post that when it becomes available.

MASA Spring Conference. It was great to see a number of SEE superintendents at the MASE Spring Conference. Special kudos go to Superintendents Beth Giese and Ray Queener for being named the Administrator of Excellence for their MASA Region, Regions 1 and 6 respectively. A number of retiring superintendents were also recognized. Among them were Dr. Linda Madsen of Forest Lake and Dr. Dave Thompson of St. Charles. Both have been stalwart SEE members for a number of years and I want to thank them for their service and support.

From the Media. There seems to be a lot more articles hitting the national media these days about education policy. This one is from The Week in Review section of Sunday's The New York Times. The article does a very good job of highlighting the importance of having an effective school principal.

Bill Introductions from Last Wednesday and Thursday

With the passage of the first policy committee deadline, bill introductions will be tailing off. There will likely still be a number of tax and funding proposals introduced in the coming two weeks, as the deadline for the funding committees is two weeks away. There has been a plethora of bills introduced this year, but it appears from the release of the omnibus policy bills that much of this proposed legislation will have to wait until next year for a true shot at being enacted.

House

Wednesday

Thursday

Senate

Wednesday

Thursday

Thursday, March 09, 2017

Deadline Approaches. We're down to one last meeting before the policy bill deadline. The Senate E-12 Policy Committee will meet tomorrow afternoon and unveil their omnibus policy bill. Today, in the final House Education Innovation Policy Committee, HF 1376, the omnibus education policy bill was heard held open in committee for amendments. There were no substantive changes to the bill, but there were some minor adjustments made. There's no question this is one of the more focused omnibus policy bills I have seen in my 27 years of lobbying education issues and it will be interesting to see what the Senate rolls out tomorrow. The House Education Innovation Policy Committee also heard HF 2259, a bill authored by House Education Finance Committee Chair Jenifer Loon. HF 2259 proposes to combine almost all of Minnesota's early learning programs and move them to the Department of Administration to be managed there. Obviously, this is a major change and battle lines are being drawn. Like so many other policies this year, there is likely to be strong disagreement between what the Legislature proposes and where the Governor stands.

The House Education Finance Committee heard HF 140, the bill that would create the Professional Educator Licensing and Standards Board. This is the House's recommendations springing from the work of the task force that tackled this topic last interim. At this point, the bill calls for the establishment of a new 11-member board (and when I say "new," it means no current members of the board will serve on the newly-appointed board) and the implementation of a tiered-licensure system that would help the state and districts determine where teacher candidates--those with licenses from other states or those non-traditional teaching candidates--sit in terms of becoming fully licensed. There is some pushback from the educator community on the perceived lack of training some teaching candidates will have and still be able to teach with a Tier One license.

The Senate E-12 Policy Committee went overtime, hearing seven bills. One bill in particular, Senator Justin Eichorn's SF 1281, produced a long, inspired debate. SF 1281 would allow public school students to take nonsectarian courses at a private school and still get credit for the course. While there are sharing agreements between public and private schools in communities throughout the state, this bill appears to be different in that parent sentiments about where their child would take a course would be up to them. Obviously, this raises a lot of questions about whether the courses taught at the private schools meet the same standards as those taught in the public schools, which could become extremely important when it comes to assessment tests. The bill is still a work-in-progress and the committee will return to it tomorrow afternoon. Senate Majority Leader Paul Gazelka's SF 1829, which helps the Eagle Valley School District reorganize its debt and modify procedures for dissolution and attachment, was heard. Committee Chair Eric Pratt's SF 1475 would penalize districts who do not reach a 95% participation rate on MCA and MTA testing. Senator Eichorn had a less controversial bill heard--and a bill that SEE supports--in SF 1474. SF 1474 is the Innovation Zone bill that has been promoted by Education Evolving and has a number of districts currently participating in a framework that allows some freedom from state mandates.

Other bills heard were:

The House Education Finance Committee heard HF 140, the bill that would create the Professional Educator Licensing and Standards Board. This is the House's recommendations springing from the work of the task force that tackled this topic last interim. At this point, the bill calls for the establishment of a new 11-member board (and when I say "new," it means no current members of the board will serve on the newly-appointed board) and the implementation of a tiered-licensure system that would help the state and districts determine where teacher candidates--those with licenses from other states or those non-traditional teaching candidates--sit in terms of becoming fully licensed. There is some pushback from the educator community on the perceived lack of training some teaching candidates will have and still be able to teach with a Tier One license.

The Senate E-12 Policy Committee went overtime, hearing seven bills. One bill in particular, Senator Justin Eichorn's SF 1281, produced a long, inspired debate. SF 1281 would allow public school students to take nonsectarian courses at a private school and still get credit for the course. While there are sharing agreements between public and private schools in communities throughout the state, this bill appears to be different in that parent sentiments about where their child would take a course would be up to them. Obviously, this raises a lot of questions about whether the courses taught at the private schools meet the same standards as those taught in the public schools, which could become extremely important when it comes to assessment tests. The bill is still a work-in-progress and the committee will return to it tomorrow afternoon. Senate Majority Leader Paul Gazelka's SF 1829, which helps the Eagle Valley School District reorganize its debt and modify procedures for dissolution and attachment, was heard. Committee Chair Eric Pratt's SF 1475 would penalize districts who do not reach a 95% participation rate on MCA and MTA testing. Senator Eichorn had a less controversial bill heard--and a bill that SEE supports--in SF 1474. SF 1474 is the Innovation Zone bill that has been promoted by Education Evolving and has a number of districts currently participating in a framework that allows some freedom from state mandates.

Other bills heard were:

- SF 1510-Goggin-Requires buildings to report monthly utility consumption into the B3 Benchmarking Program

- SF 1756-Utke-Modifies the Alternative Licensure Program

- SF 1847-Kent-Modifies Student Assessment Disaggregation Process

Wednesday, March 08, 2017

Rapid Fire Wednesday. Only two committee meetings, but both rattled off bills with time to spare. The House Education Finance Committee heard SF 485, Representative Paul Anderson's bill that provides grants for agricultural educators to run summer programs. Representative Dean Urdahl's HF 1024 would change the small schools revenue to accommodate districts up to 1,500 pupil units. The current formula phases out at 980 pupil units. Tax Chair Greg Davids' HF 786 would allow districts to re-finance their maximum effort loans. As you may recall, last year the Legislature netted $50 million by forcing (Oops. I mean "strongly encouraging.) six districts with maximum effort loans to pay them off early, saving the state money in the process. It was thought that no districts would be interested in following suit, but lo and behold, there are. HF 1428, Speaker Kurt Daudt's bill, would clarify the nonresident tuition rate for court-placed students. Representative Matt Grossell's HF 1220 is a local bill for the Nevis school district that would allow them to spread the levy resulting from the conversion of previous referendum authority over a number of years. Last, but certainly not the least, was Representative Peggy Bennett's HF 1680, which is also known as Erin's Law. Erin's Law is named after Erin Merryn, a survivor of childhood sexual abuse and she has made it her mission to promote educational curriculum and activities that will reduce instances of this horrific crime. Two adult survivors of sexual abuse as children testified in favor of the bill and their words were certainly moving. Here is a link to the Erin's Law website for more information about efforts to lessen, and hopefully eliminate, child sexual abuse: Erin's Law

The Senate E-12 Policy Committee likewise heard five bills. Two of the bills that were heard were authored by E-12 Funding Chair Carla Nelson: SF 1397 and SF 1056. SF 1397 would provide greater stability to students in foster care by awarding a pilot project for a district to develop a program that ensures students in foster care can maintain a consistent educational program. SF 1056 provides a great to promote Advanced Placement and International Baccalaureate programs. E-12 Policy Chair Eric Pratt's SF 711, a bill that would fund education partnerships, was also heard and it had a great set of witnesses attesting to how programs like St. Paul's Promise Neighborhood and Minneapolis' Northside Achievement Zone are accomplishing great things by bringing together education, human services, other community support services, nonprofits, and volunteers to narrow the achievement gap. SF 453 is Senator Roger Chamberlain's bill on assisting students with dyslexia, largely by creating a position in the Minnesota Department of Education to help school districts develop interventions to help struggling readers get to grade level. The last bill of the day was SF 855, a bill authored by Senator Patricia Torres Ray that would provide funding to school districts to augment basic skills revenue for students with limited or interrupted formal education.

The Senate E-12 Policy Committee likewise heard five bills. Two of the bills that were heard were authored by E-12 Funding Chair Carla Nelson: SF 1397 and SF 1056. SF 1397 would provide greater stability to students in foster care by awarding a pilot project for a district to develop a program that ensures students in foster care can maintain a consistent educational program. SF 1056 provides a great to promote Advanced Placement and International Baccalaureate programs. E-12 Policy Chair Eric Pratt's SF 711, a bill that would fund education partnerships, was also heard and it had a great set of witnesses attesting to how programs like St. Paul's Promise Neighborhood and Minneapolis' Northside Achievement Zone are accomplishing great things by bringing together education, human services, other community support services, nonprofits, and volunteers to narrow the achievement gap. SF 453 is Senator Roger Chamberlain's bill on assisting students with dyslexia, largely by creating a position in the Minnesota Department of Education to help school districts develop interventions to help struggling readers get to grade level. The last bill of the day was SF 855, a bill authored by Senator Patricia Torres Ray that would provide funding to school districts to augment basic skills revenue for students with limited or interrupted formal education.

Tuesday, March 07, 2017

House Education Policy Bill Released. The House Education Innovation Policy Committee released HF 1376, the House's 2017 omnibus education policy bill. The bill is only 41 pages long, which is emaciated by usual policy bill standards. Chair Sondra Erickson said it was her goal to not burden school districts with additional mandates with the last few years saddling so many new duties on districts. Here is the bill summary: HF 1376 Bill Summary. The bill was presented today and amendments will be offered on Thursday. It will be interesting to see how many amendments are offered and whether or not they go on the bill.

The House Education Innovation Policy Committee also heard Representative Jim Nash's SF 1944, a bill that would create an apprenticeship program for senior high students and provide a tax credit for businesses that partner with a school to create apprenticeship opportunities. Last, but not least, the committee heard Representative Jenifer Loon's SF 1906 that modifies post-secondary enrollment options by adding additional states as eligible participants.

The House Education Finance Committee heard four bills. They were:

HF 268-Theis-Grants to the Sanneh Foundation for Work with Chronically-Absent and Low-Performing Students

HF 670-Scott-Making Compensatory Pilots Permanent

HF 1661-Lee-Modifies Graduation Incentives Program

HF 1874-Poston-Funding for Collaborative Urban Educator Program

The Senate E-12 Policy Committee closed out the day hearing six bills. Four of the bills were authored by Committee Chair Eric Pratt. Those bills were SF 1171, a bill that cleans up charter school law; SF 1476, a bill that allows districts to post school board proceedings online; SF 1071, a bill that clarifies procedures districts must follow when applying for grants; and SF 1471, a bill that would make state test results available to school districts and teachers within two weeks of being taken. Senator Roger Chamberlain's bill--SF 1582--that would allow charter schools to change authorizers was also heard as was Senator Carla Nelson's SF 1663, a bill that makes children down to birth eligible for the early childhood scholarship program.

The Senate needs to pass its omnibus policy bill out of the E-12 Policy Committee by Friday and it will be interesting to see what the timeline is for the bill's release. I will keep you posted.

The House Education Innovation Policy Committee also heard Representative Jim Nash's SF 1944, a bill that would create an apprenticeship program for senior high students and provide a tax credit for businesses that partner with a school to create apprenticeship opportunities. Last, but not least, the committee heard Representative Jenifer Loon's SF 1906 that modifies post-secondary enrollment options by adding additional states as eligible participants.

The House Education Finance Committee heard four bills. They were:

HF 268-Theis-Grants to the Sanneh Foundation for Work with Chronically-Absent and Low-Performing Students

HF 670-Scott-Making Compensatory Pilots Permanent

HF 1661-Lee-Modifies Graduation Incentives Program

HF 1874-Poston-Funding for Collaborative Urban Educator Program

The Senate E-12 Policy Committee closed out the day hearing six bills. Four of the bills were authored by Committee Chair Eric Pratt. Those bills were SF 1171, a bill that cleans up charter school law; SF 1476, a bill that allows districts to post school board proceedings online; SF 1071, a bill that clarifies procedures districts must follow when applying for grants; and SF 1471, a bill that would make state test results available to school districts and teachers within two weeks of being taken. Senator Roger Chamberlain's bill--SF 1582--that would allow charter schools to change authorizers was also heard as was Senator Carla Nelson's SF 1663, a bill that makes children down to birth eligible for the early childhood scholarship program.

The Senate needs to pass its omnibus policy bill out of the E-12 Policy Committee by Friday and it will be interesting to see what the timeline is for the bill's release. I will keep you posted.

INTRODUCTIONS

There weren't a lot of bill introductions today because both Houses and the Legislature are meeting Monday through Thursday this week to process bills to meet the first committee deadline, which is Friday. So here is the abbreviated list of introductions.

House

Senate

Monday, March 06, 2017

Equalization Bill Heard. SF 1206--the referendum and debt service equalization bill that SEE has played a major role in developing--was heard in the Senate E-12 Finance Committee this afternoon. Testifiers included Pine Island Superintendent Dr. Tamara Berg-Beniak, South St. Paul Superintendent Dr. David Webb, South St. Paul student Andres Fernandez Alvarez, and yours truly. The bill received a warm reception, but at a cost of $80+ million, it does put a bit of a shiver through legislators who want to curb spending. It's always important to remind those with concerns that this is tax relief and is a tax cut to hard-working Minnesotans who support their school districts by passing ballot initiatives for both operations and buildings. My thanks go to chief author Senator Dave Senjem, co-authors Senator Andrew Lang, Senator Chuck Wiger, Senator Jim Abeler, and Senator Ann Rest. Thanks should also go to E-12 Finance Chair Carla Nelson who is also a very strong supporter of equalization. The bill was re-referred to the Tax Committee where some measure of the bill may find its way into the Senate tax bill.

Other bills heard today included SF 1419, Senator Jerry Relph's bill to fund the Promise Neighborhood of Central Minnesota and three bills authored by Senator Carla Nelson: SF 1555, a bill that provides funding for the Increase Teachers of Color Act; SF 1558, a bill that modifies the calculation of aid to nonpublic schools; and SF 1207, a bill that would provide for third-party payment of evaluations for special education services.

Other bills heard today included SF 1419, Senator Jerry Relph's bill to fund the Promise Neighborhood of Central Minnesota and three bills authored by Senator Carla Nelson: SF 1555, a bill that provides funding for the Increase Teachers of Color Act; SF 1558, a bill that modifies the calculation of aid to nonpublic schools; and SF 1207, a bill that would provide for third-party payment of evaluations for special education services.

INTRODUCTIONS

House

Sunday, March 05, 2017

Getting a Head Start on the Week. It's going to be a busy week as the first policy deadline approaches, so I thought I would get ahead of the curve in the blogging game. The Senate posts Monday's bill introductions on Saturday, so I'm actually a day late getting them to you. So here they are:

INTRODUCTIONS

Senate

School Choice Hits the National Scene. The Trump Administration hasn't said a lot about education, but it appears that increased school choice--including the use of public dollars for private education--will be a central element if and when his education platform is rolled out. This issue has been debated at the state level by a number of legislatures and many of these states allow for public school choice and, in some cases, limited use of school vouchers. Seeing that the Federal government only funds about 10% of education costs nationally, it will be interesting to see how greater choice is promoted and what it entails. President Trump is right when he says education is an important civil rights issue (a number of folks on both sides of President Trump don't consider it the biggest, or most pressing civil rights issue, but I digress), but how to ensure access to quality education programs throughout the country will be a daunting task.

What makes it even more daunting is the fact that the evidence that school choice improves educational outcomes simply doesn't seem to be there to support some of the initiatives the Trump Administration is expected to promote. That, along with concerns about the potential for financial hi-jinks at private and charter schools, dull enthusiasm for these reforms.

Here are a couple of articles in that vein:

From The New York Times: For Trump and DeVos, a Florida Private School Is a Model for Choice

From The New York Times (Yet again): Dismal Voucher Results Surprise Researchers as DeVos Era Begins

From The American Prospect (Left of Center): How States Turn K-12 Scholarships Into Money-Laundering Schemes

Thursday, March 02, 2017

Full Day. Between committee hearings and bill introductions, it's been another day of wall-to-wall action at the Legislature. As is the case on every Thursday, the House Education Innovation Policy Committee led things off. The committee heard five bills, starting with Representative Paul Anderson's (there is also a Senator Paul Anderson) HF 485. HF 485 would fund a grant program to pay for agricultural education during the summer months. It is the companion to Senator Gary Dahms' SF 618, which was heard earlier in the session. The committee then heard Representative Dave Baker's HF 535, another bill that whose companion--SF 494--has also been heard. HF 535 makes two sites in the Willmar school district state-approved alternative programs. HF 1663--Chair Sondra Erickson's bill on alternative teacher licensure--was also heard along with Representative Dario Anselmo's HF 1083 and Representative Steve Drazkowski's HF 1421. Representative Anselmo's bill would give priority on open enrollment decisions to students who live in the same municipality as a district but due to school district boundaries attend a different school. The genesis of this bill springs from the fact that there is a small section of the city of Edina that is in the Hopkins school district. The Edina residents from this neighborhood have long attempted to get their students into the Edina school district somehow, going as far as to have legislation introduced to change the school district boundaries. Those attempts failed and this is a new approach to solving that issue. Representative Drazkowski's bill would allow school districts to adopt policies that would promote e-learning on snow days in order to avoid lengthening the school year or cancelling staff development days to meet school calendar guidelines.

The House Education Finance Committee heard HF 1801, Chair Jenifer Loon's bill that would fund the parent-child home visiting program. This has proven to be a very effective early-learning model. I don't know if I ever linked this story before, but the left-leaning The Washington Monthly had a story on this model (not the Minnesota experience, but a similar program elsewhere): Closing the Pre-School Gap at Home. Representative Joe Hoppe's HF 1612 was up next. HF 1612 is the companion to SF 1026 and would make up deficits in school district transportation funds with state aid. This bill would help 14 SEE districts, none more than Forest Lake, which due to geography and development patterns has extremely high transportation costs. This is a shared experience in a number of districts at the edge of the metropolitan area where the placement of school buildings (often years ago) don't jibe with where development within a school district has taken place. It has also plagued a number of large rural districts. The committee also heard two bills that would fund museums: Representative Dario Anselmo's HF 1449 that would provide funding for The Children's Museum and Representative Clark Johnson's HF 1190 that would provide funding for The Children's Museum of Southern Minnesota.